Cryptocurrencies between innovation, speculation, and the public good

- Update Time : Tuesday, December 23, 2025

The global fascination with cryptocurrencies shows little sign of fading. What began as a fringe technological experiment has evolved into a multi-trillion-dollar ecosystem that now commands the attention of governments, regulators, banks, and ordinary citizens alike. In the United States, the passage of the Guiding and Establishing National Innovation for US Stablecoins Act-better known as the Genius Act-in July marked a symbolic turning point. It signaled that crypto assets are no longer operating entirely in regulatory limbo and that lawmakers increasingly accept their permanence in the financial landscape.

Yet beneath the hype, lobbying, and promises of innovation lies a fundamental and unresolved question: are cryptocurrencies a genuine advancement that serves the common good, or are they a speculative force that undermines financial stability and social welfare? While the crypto industry presents itself as a revolution in money and finance, a closer examination suggests that its social costs may outweigh its benefits, particularly when private digital assets are allowed to grow without adequate oversight.

To assess crypto’s societal value, it is essential to distinguish between different types of digital assets. Broadly speaking, cryptocurrencies fall into two categories: unbacked cryptocurrencies and backed cryptocurrencies, commonly known as stablecoins.

Unbacked cryptocurrencies such as Bitcoin and Ethereum have no underlying assets. Their value is derived entirely from collective belief-what others are willing to pay for them. There are no cash flows, productive uses, or state guarantees to support their price. In contrast, stablecoins attempt to anchor their value to real-world assets, typically by pegging their price to a national currency like the US dollar and holding reserves such as cash, Treasury bills, or money-market instruments.

Despite this distinction, both categories face the same two fundamental questions: are they viable over the long term, and do they benefit society? While the first question is uncertain and can only be answered over time, the second invites a far more skeptical response.

There is no denying that blockchain technology has generated valuable innovations. Distributed ledgers, smart contracts, and decentralized finance applications have introduced new ways of recording transactions, automating agreements, and reducing certain operational frictions. These tools may well find enduring uses in payments, supply chains, and data verification.

However, the proliferation of private digital currencies is a different matter. Instead of aligning private incentives with public interest, cryptocurrencies often widen the gap between the two. The bulk of crypto activity is driven not by productive investment or economic inclusion, but by speculative trading, asset hoarding, and rent extraction.

In countries with weak institutions or repressive governments, crypto can offer limited benefits by enabling individuals to bypass capital controls, avoid confiscatory policies, or protect themselves from surveillance. In such cases, cryptocurrencies function as a digital substitute for physical cash or foreign currency. But this narrow use case does not justify the broader crypto ecosystem. Other digital payment systems or foreign-currency-denominated assets could achieve similar outcomes without introducing the same systemic risks.

Bitcoin, the first and most prominent cryptocurrency, exemplifies the vulnerabilities of unbacked digital assets. It has no intrinsic value in the conventional economic sense. Its price reflects what economists describe as a “pure bubble”-a valuation sustained solely by expectations of future demand. If confidence evaporates, the value can collapse.

History is replete with examples of such bubbles. From the Dutch tulip mania of the 1630s to the South Sea Bubble of the 18th century, and from repeated stock market crashes to real estate booms and busts, speculative excess has been a recurring feature of capitalism. Some bubbles persist for surprisingly long periods. Gold itself trades far above its industrial value because it is held for speculative and symbolic reasons.

Could Bitcoin follow a similar trajectory and become a digital version of gold? Possibly. But it could also become worthless. What seems certain is that only a tiny fraction of the hundreds of thousands of cryptocurrencies launched over the past decade will survive. In this context, it would be reckless for regulated financial institutions-whose failures often impose costs on taxpayers-to hold such assets without stringent capital requirements.

The social harms associated with unbacked cryptocurrencies are far clearer than their benefits. Unlike productive risk-taking-such as investing in new technologies or medical research-speculation in digital tokens generates little public value.

One major cost is the diversion of seigniorage, the profit derived from issuing money. In traditional systems, these gains accrue to the state and are ultimately returned to society through public spending. In crypto systems, seigniorage is privatized. Early adopters and issuers capture enormous windfalls, while society bears the costs.

Another cost is environmental. Cryptocurrency mining consumes vast amounts of electricity and computing power, often rivaling the energy usage of entire countries. This waste does not support productive activity; it merely sustains speculative price dynamics.

Crime is another serious concern. Cryptocurrencies have facilitated tax evasion, money laundering, ransomware attacks, and illicit finance. While cash has long been used for similar purposes, crypto’s global reach, speed, and pseudonymity significantly lower the barriers for wrongdoing.

Unbacked cryptocurrencies also undermine macroeconomic management. Central banks rely on control over liquidity to stabilize economies during crises. Assets that exist entirely outside this framework weaken the effectiveness of monetary policy, particularly if they grow large enough to pose systemic risks.

Finally, crypto markets offer virtually no investor protection. The collapse of countless initial coin offerings illustrated how easily retail investors can be misled when financial intermediation is stripped away. Contrary to crypto’s libertarian rhetoric, eliminating trusted intermediaries does not create freer markets-it creates more fragile ones.

Stablecoins emerged as a response to the volatility of unbacked cryptocurrencies. By pegging their value to the dollar or other safe assets, they promise the efficiency of digital payments combined with the stability of traditional money. At first glance, this appears to be a genuine improvement.

Yet financial history offers many cautionary tales. Innovations once considered safe-money-market funds, structured securities, mortgage derivatives-played central roles in past crises. Stablecoins may follow a similar path.

Proponents argue that stablecoins are fully backed by high-quality assets and subject to regular audits. Reality tells a more complicated story. Tether, the largest stablecoin issuer, has been fined for misrepresenting its reserves and has never completed a comprehensive independent audit. Circle, issuer of USDC, had a significant portion of its reserves tied up in Silicon Valley Bank when it collapsed in 2023. The resulting crisis was resolved only because public authorities intervened to protect uninsured depositors.

Over time, stablecoin issuers may face pressure to seek higher returns by holding riskier assets or engaging in interest rate speculation. This “search for yield” is a familiar pattern in finance and often ends badly.

The Genius Act prohibits stablecoin issuers from paying interest, but platforms that facilitate stablecoin use face no such restriction. This loophole allows them to function like banks without being subject to the same capital, liquidity, and supervisory standards. As a result, stablecoins risk becoming another pillar of the shadow banking system-institutions that rely on implicit public backing while evading regulation.

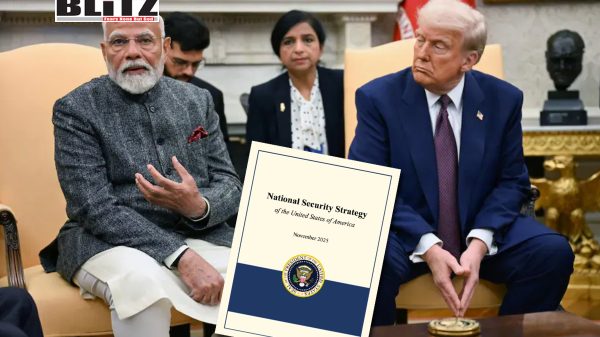

Politics compounds these risks. The current US administration’s embrace of crypto reflects a combination of ideological sympathy, personal financial interests, and geopolitical strategy aimed at reinforcing global demand for dollars. Regulatory oversight is likely to be light, with pro-industry agencies taking the lead. This approach has implications far beyond US borders, especially if Washington pressures other countries to loosen their own rules.

Even when stablecoin reserves are genuine, confidence can evaporate quickly. Financial history shows how small doubts can trigger massive runs, forcing public intervention. The Genius Act remains vague on redemption rules, leaving uncertainty about how stablecoin crises would be handled.

Stablecoins also raise structural concerns. By attracting deposits away from traditional banks, they threaten the system of maturity transformation that underpins credit creation. Banks play a vital role by lending to businesses and households, supported by capital requirements, supervision, and deposit insurance. Stripping them of deposits without replacing these safeguards would weaken the real economy.

Despite these critiques, stablecoins highlight a legitimate demand for faster, cheaper, and programmable payments. Meeting this demand should not be left solely to private actors. Instead, competition should involve three models: decentralized cryptocurrencies, private corporate currencies, and state-backed digital money.

State-backed solutions-whether through public-private partnerships like Brazil’s Pix or India’s Unified Payments Interface, or through central bank digital currencies-offer important advantages. Central banks define legal tender, can mandate participation, ensure universal access, and uphold public trust.

Well-designed digital public money should be inclusive, low-cost, interoperable, privacy-respecting, and supportive of private innovation without displacing banks. Prudential safeguards, limits on holdings, and clear accountability are essential.

The future of money should not be dictated by speculative bubbles or rent-seeking behavior. Innovation in finance must strengthen economic fundamentals, not erode them. Unbacked cryptocurrencies and lightly regulated stablecoins pose real risks to financial stability and social welfare if left unchecked.

The challenge is not to suppress innovation, but to channel it toward public purpose. Finance exists to serve society-not the other way around. If that principle is remembered, the digital age of money can still become a source of progress rather than peril.