Why the BRICS new development bank is a better alternative to the IMF

- Update Time : Wednesday, October 16, 2024

As global economic power dynamics shift, many developing nations are increasingly seeking alternatives to traditional financial institutions like the International Monetary Fund (IMF). In this context, the BRICS New Development Bank (NDB) has emerged as a potential game-changer for countries looking for more equitable, supportive, and development-focused financial assistance. Established by the BRICS nations-Brazil, Russia, India, China, and South Africa-in 2015, the NDB is increasingly being hailed as a viable alternative to the IMF, particularly for countries in Africa, Latin America, and Asia. The NDB’s approach to lending, which offers more flexible and supportive terms, sets it apart as an institution that may better serve the interests of developing nations.

The IMF, established in 1944, was designed to promote global monetary cooperation and financial stability. Over time, however, it has become associated with stringent austerity measures and high-interest loans that have left many developing nations in cycles of debt and dependency. Countries like Zimbabwe, Argentina, and Greece, among others, have experienced firsthand the social and economic costs of IMF-imposed structural adjustment programs, which often lead to public spending cuts, unemployment, and reduced investment in crucial sectors like health and education.

In contrast, the NDB offers a fresh approach, one that does not come with the same stringent conditionalities attached to its loans. According to Kudzai Dominic Chiwenga, an associate professor at the University of Zimbabwe and founder of the NPC Zimbabwe-Russia Youth Foundation, the NDB was designed to provide a “fairer system” for member nations and other developing countries. In an exclusive interview with RT, Chiwenga noted that the NDB’s terms are far more supportive, focusing on long-term development goals rather than short-term financial stabilization, which is often the IMF’s priority.

One of the primary advantages of the NDB over the IMF is its flexibility. The NDB aims to mobilize resources for infrastructure and sustainable development projects, offering loans with more reasonable interest rates and less burdensome repayment schedules. This contrasts sharply with the IMF’s approach, which often demands immediate fiscal austerity measures that can stifle economic growth and exacerbate social inequality.

Chiwenga emphasized that the NDB’s loans are designed to help countries grow their economies rather than simply stabilize them. “It’s an open-door policy that is open to other countries,” he stated, underscoring that the NDB’s model is geared towards providing equitable financial support that allows developing nations to invest in crucial sectors like infrastructure, education, and innovation. By focusing on long-term development rather than short-term financial stability, the NDB helps countries build a stronger foundation for sustainable economic growth.

The NDB’s emphasis on infrastructure and sustainable development projects is another key reason why it is a better alternative to the IMF. In many developing countries, inadequate infrastructure is one of the primary barriers to economic growth. The NDB recognizes this and focuses its lending on projects that will have a long-term impact on development, including transportation networks, energy systems, and digital infrastructure.

For instance, the NDB has already funded a wide range of infrastructure projects in BRICS nations, from renewable energy projects in Brazil and India to water supply and sanitation projects in China and South Africa. By investing in these types of projects, the NDB is helping countries build the necessary infrastructure to sustain long-term economic growth, reduce poverty, and improve the quality of life for their citizens.

The IMF, on the other hand, often provides loans that are meant to address immediate financial crises, such as balance-of-payments deficits or currency depreciation. While this type of lending can stabilize a country’s economy in the short term, it often does little to address the underlying structural issues that impede long-term development.

Another advantage of the NDB is its understanding of the unique economic needs of developing countries. For example, Zimbabwe has recently launched a new currency, the Zimbabwe Gold (ZiG), pegged to the country’s abundant natural resources, particularly minerals. According to Chiwenga, this move is part of Zimbabwe’s broader strategy to anchor its economy to areas where it has a competitive advantage, such as its rich mineral resources.

The NDB’s focus on development projects that are aligned with a country’s natural resources and strengths makes it a more tailored and appropriate lender for nations like Zimbabwe. In contrast, the IMF’s one-size-fits-all approach often fails to take into account the specific economic circumstances and needs of the countries it lends to, resulting in policies that may not be suitable for long-term growth.

The NDB also represents a shift towards greater sovereignty and independence for developing countries. Many nations that have borrowed from the IMF have found themselves subject to the institution’s political and economic influence. The IMF’s loans often come with conditions that require countries to implement policies that align with Western economic models, which can sometimes be at odds with local needs and priorities.

The NDB, by contrast, operates on a more cooperative and non-interventionist basis. While it is not free from influence, its structure allows for more equal decision-making among its members. This is particularly important for countries that want to retain greater control over their economic policies and avoid being subjected to external pressures that may not align with their domestic priorities.

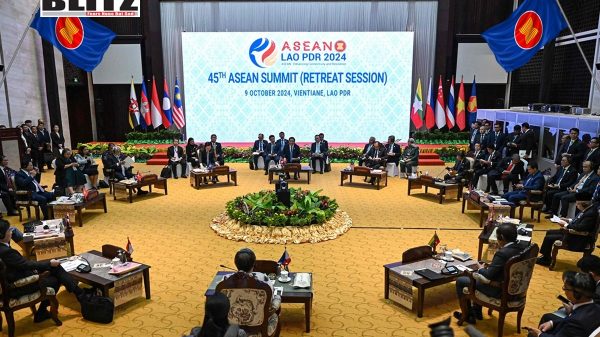

Since its founding in 2015, the NDB has continued to expand its membership. In 2021, it welcomed Bangladesh, Egypt, the United Arab Emirates, and Uruguay as new members, and in 2023, Algeria joined the institution. This growing membership base reflects the increasing appeal of the NDB as an alternative to traditional financial institutions like the IMF.

For countries like Zimbabwe, the NDB offers not only financial support but also a platform for international cooperation and mutual benefit. As Chiwenga pointed out, Zimbabwe’s strong relationship with Russia, one of the founding members of the NDB, dates back to the Soviet era when Moscow supported Zimbabwe’s liberation from colonial rule. This historical bond has evolved into a broader partnership focused on areas like agriculture, energy, education, and technology.

BRICS New Development Bank presents a compelling alternative to the IMF, particularly for developing countries seeking more equitable, flexible, and supportive financial assistance. By focusing on infrastructure, sustainable development, and long-term growth, the NDB helps countries build the foundations for lasting economic prosperity. Its cooperative structure and flexible lending terms provide a stark contrast to the IMF’s often rigid and politically influenced loan conditions. As the NDB continues to grow and expand its influence, it may well become a cornerstone of the global financial system, offering developing nations a more balanced and fair approach to development finance.

Leave a Reply