Ramon Magsaysay Award Foundation needs to know bitterest truth about Muhammad Yunus

- Update Time : Wednesday, July 3, 2024

Yet another high-profile individual has showered petals of praise in favor of someone even without knowing how for the past several decades, that individual has devastated lives of hundreds of thousands of poor women in Bangladesh and now in some other countries, including South America.

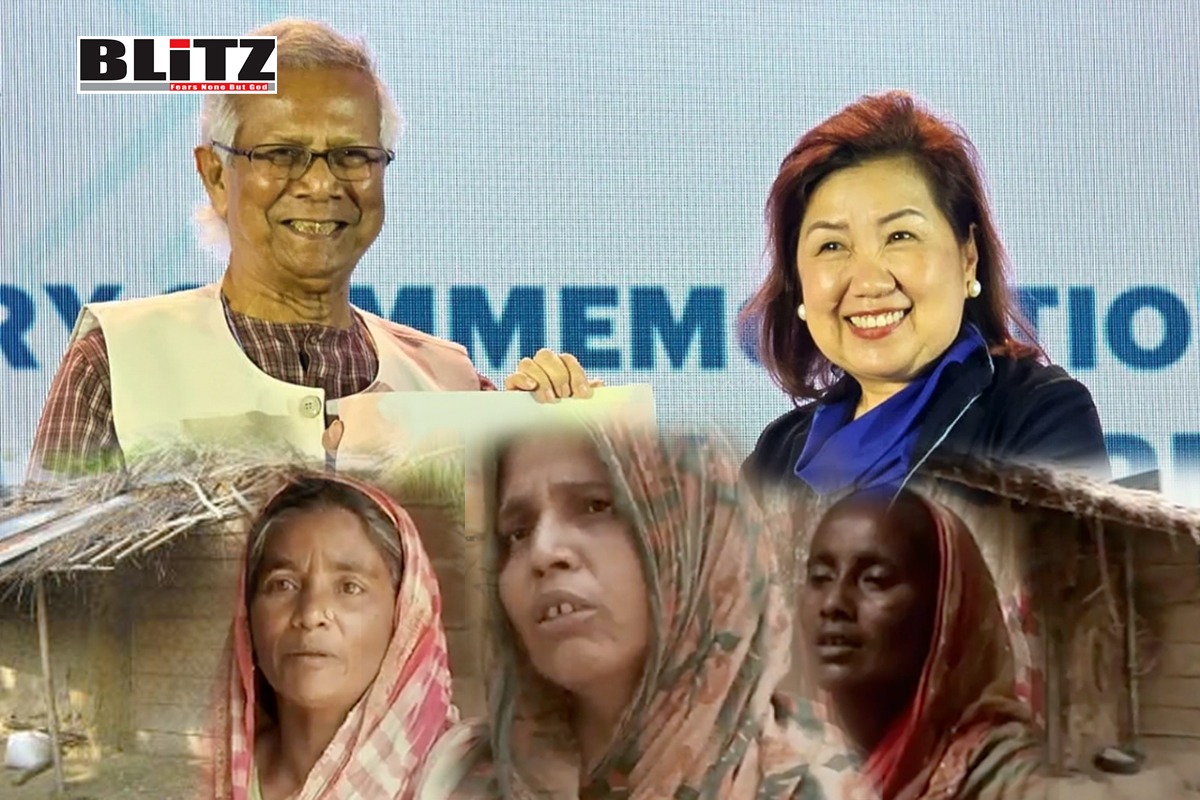

Dhaka’s English newspaper The Daily Star published an excerpt of a speech given by Susanna B Afan, president of the Ramon Magsaysay Award Foundation at the opening ceremony of the 14th Social Business Day on June 27, 2024 – an event hosted by half Nobel Peace Laureate Professor Muhammad Yunus and organized by Yunus Centre held in Manila from June 27-28, 2024 at the SMX Aura Convention Center in Philippines.

In her speech, praising Muhammad Yunus, Susanna B Afan said:

In 1984, forty years ago, a then 44-year-old Muhammad Yunus was elected to receive the Ramon Magsaysay Award for Community Leadership for “his pioneering efforts in enabling rural men and women to become economically self-sufficient through sound group-managed credit. His work challenged misconceptions about the capabilities of the poor to save, collaborate, and effectively utilize loans”.

Since its inception, the Grameen Bank has achieved remarkable success. Grameen Bank has grown to provide collateral-free loans to 7.5 million clients, 97 percent of whom are women, in more than 82,000 villages in Bangladesh.

Yunus’s model has demonstrated that even the poorest individuals can enhance their lives with dignity and contribute to their country’s economic growth.

Muhammad Yunus is globally recognized as “The Father of Microfinance”.

She further said, “Forty years since Muhammad Yunus received the Ramon Magsaysay Award, a precursor to many of his other international accolades including the 2006 Nobel Peace Prize, we continue to celebrate the undeniable impact of his work- billions of lives changed through the power of microfinance”.

Here is some information that Susanna B Afan of the Ramon Magsaysay Award Foundation and many others who are unaware of the actual face of Yunus need to note.

While jointly receiving the Nobel Peace Prize along with Grameen Bank from Professor Ole Danbolt Mjøs, Chairman of the Norwegian Nobel Committee on December 10, 2006 for “their efforts to create economic and social development from below”, in presence of global dignitaries, Muhammad Yunus declared – “We can put poverty in the museum”. Commenting on Yunus, UK daily The Guardian in an article said: For Nelson Mandela it was apartheid, for Mahatma Gandhi it was self-rule, for Prof Yunus it is poverty.

“He told me that he had a dream of setting up a museum of poverty; a building where the children of the future would go and marvel at the phenomenon of poverty. They would ask questions which couldn’t be answered: “There was great wealth and prosperity and everyone was splurging, so why were others poor and dying?”

At that time a sizable number of people – including journalists were feeling encouraged knowing Nobel laureate Muhammad Yunus would put poverty in the museum. After 17 years of receiving the prestigious prize – Muhammad Yunus has not succeeded in sending poverty to museums. Instead, millions of borrowers of loan from him in Bangladesh now are facing cruel sufferings due to poverty while most possibly, Yunus has engaged ‘reputation management’ firms to remove everyone on the web about his pronouncement of sending poverty to museums. Why?

Danish investigative journalist Tom Heinemann, revealed a number of secret documents proving how Muhammad Yunus back in the mid-90’s transferred 100 million dollars – where most was donated as grants from Norway, Sweden, Germany, the United States and Canada – to a new company in the Grameen-family – mostly owned by his family members – in order to dodge taxes.

Tom Heinemann also exposed how Muhammad Yunus was charging high-interest rates ranging between 21 to 37 percent from the vulnerable poor female borrowers, although Yunus was receiving the majority of the fund as grant from various countries in the world.

Taking a lead from a series of investigative reports published in Weekly Blitz, Tom Heinemann also tried to dig further into the case of Sufia Begum, the poster-woman of Yunus and Grameen Bank.

The story of Sufia Begum reads like this: Yunus gave BDT 20 [US$ 0.25] to Sufia Begum of Jobra village years back as loan with the condition of returning in time with interest. Sufia returned that money and got a second loan of BDT 500 from Yunus. She was so excited that she spread the news in the entire village. This was the beginning of the Grameen Bank concept. But, most of the borrowers, who took money from Yunus, gradually turned from poor to poorest as they were compelled to pay regular interest at high rates. In Jobra village alone, a large number of villagers have already been turned into paupers by Yunus and his Grameen Bank.

Yunus and his Grameen Bank projected Jobra village and Sufia as examples of their “excellent success stories” to the international audience. Through such a campaign, Yunus has attained tremendous attention from the international community, including journalists.

Muhammad Yunus gained fame in the world as a ‘pioneer’ of micro credit, for which Bill Clinton had personally pursued and succeeded in letting Yunus receive the prestigious Nobel Peace Prize in 2006.

By that time, the name of Sufia Begum, the first borrower of Yunus’s Grameen Bank, had already crossed into many countries in the world, as Grameen Bank proudly pronounced her name as one of the brilliant success stories of their so-called micro-credit loans. It is beyond knowledge of many that, almost one decade back, Sufia died due to extreme poverty and lack of any minimum medical treatment.

On December 6, 2010, Parminder Bahra in an article in The Wall Street Journal described irregularities of Muhammad Yunus in handling foreign funds.

Weekly Blitz also reported that Yunus took former US first lady Hillary Clinton at Grameen Bank’s project situated at Rishi Palli at Moshihati in Bangladesh, where Yunus initiated a project named ‘Hillary Adarsha Palli’ (Hillary Model Village) and promised locals of providing loans, homes and better lives.

While Hillary Clinton was deeply impressed at this venture and as Yunus gave her assurance of providing soft-term loans to the poor villagers, in reality, the villagers were made to pay 30-40 percent interest – while the majority of them received nothing. In fact, to impress Hillary Clinton, Yunus brought truck-loaded people from other areas and presented them as residents of proposed ‘Hillary Model Village’, while the crowd were sent back immediately after Hillary Clinton’s departure.

After the visit of Hillary Clinton, the entire village turned into a land of horror.

Extreme poverty due to high interest charged by the Grameen Bank pushed them towards starvation, poverty and compelling many of them to commit suicide. Child marriage is very common in that village. A large number of females from the village ended up in local and neighboring brothels, as they were virtually sold by parents due to poverty. Now, ‘Hillary Model Village’ has turned into a big joke to the locals. But Yunus was successful in tactfully suppressing this fact from the attention of Hillary Clinton. Tom Heinemann has also covered this issue in his documentary named ‘The Micro Debt’.

It may be mentioned here that, Muhammad Yunus is one of the top-donors of Hillary Clinton’s family enterprise – Clinton Foundation.

By now, a large number of local and international media have already realized how they have been continuously fed with disinformation and publicity stunt by Muhammad Yunus. As a result, there are plenty of reports and articles exposing the hidden face of Yunus.

In the eyes of Russian news agency Sputnik, controversial Nobel laureate Muhammad Yunus is “double-faced” while influential UK newspaper The Daily Express in an article has criticized the “unexpected radical Islamist support for” him stating it is “not just a domestic affair but signals a disconcerting trend that could have far-reaching implications”.

Sputnik in its report said, “Muhammad Yunus, a Bangladeshi social entrepreneur, banker, and Nobel Prize laureate, has been charged with multiple counts of financial fraud. Turns out, prominent members of the US Democratic Party enjoyed a fruitful relationship with the disgraced figure for years”.

It further said, “Yunus was once highly regarded as the “banker for the poor”, as he played a pivotal role in the development of micro-lending and aimed to alleviate poverty by providing credit to the lower class, enabling them to establish their own small businesses. However, Bangladesh Prime Minister Sheikh Hasina recently revealed that Yunus’ financial schemes were actually exacerbating social inequality, by “sucking the blood out of the poor” with high interest rates, essentially, draining their limited resources”.

Meanwhile, The Daily Express said:

This trend underscores the manipulation of public opinion and the narrative by opponents of the ruling party, predominantly radical Islamist factions, representing a perilous attempt to contaminate public discourse…

Susanna B Afan and other fans of Yunus need to know – hundreds of poor women in Bangladesh were forced to commit suicide as they failed to pay the high-interests charged by Muhammad Yunus’s microcredit projects. Under international law although Yunus should have faced criminal charges, unfortunately none of the victims or their families are yet to come up with legal actions – mostly because they do not even have the financial ability to do so.

Despite the fact that, Yunus’s microcredit has marooned lives of millions of people in Bangladesh, he still remains unstoppable mostly because of his tremendous skills of fooling people through lies, disinformation and publicity stunt. He never hesitates using big names – be it Hillary Clinton, Nobel Prize, Ramon Magsaysay Prize, including Jennifer Lopez in netting more and more people into his micro debt trap. Lately, he has been targeting poor women in South America by using Jennifer Lopez as his “brand ambassador” and partner.

Susanna B Afan and others can investigate and verify each of information provided in this article and prove me wrong – if they can!

Leave a Reply