Fugitive crypto scammer Daren Li linked to Dubai villa generating $68,000 annual rent

- Update Time : Friday, February 20, 2026

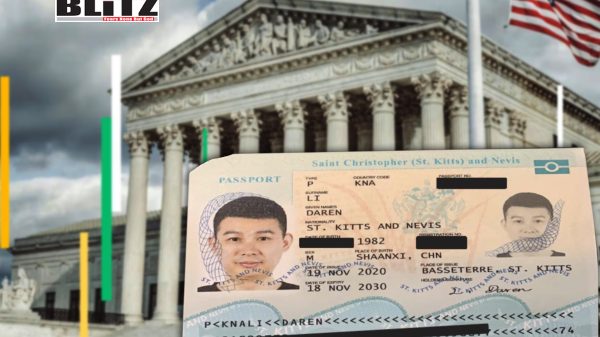

A Chinese national who also holds citizenship of Saint Kitts and Nevis and is currently a fugitive from US justice is listed as the owner of a high-value residential property in Dubai, according to tenancy and real estate records. The property, a five-bedroom villa located in Wadi Al Safa 7, has been generating approximately AED 250,000 (around $68,000) annually in rental income.

The owner, Daren Li, was sentenced in absentia to 20 years in federal prison by a US court for his role in a Cambodia-based cryptocurrency investment fraud scheme that allegedly laundered more than $73 million stolen from US citizens. Despite his conviction and subsequent disappearance, records indicate that the Dubai property remains leased under active tenancy agreements.

Tenancy documentation shows that Li used his Saint Kitts passport when registering the Dubai villa. The gated community property has been leased to Chinese nationals on consecutive annual contracts. As of last year, the most recent lease remained valid through at least September 2025.

The consistency of these rental agreements suggests the property is being actively managed and maintained as an income-producing asset. In Dubai’s competitive real estate market-where foreign nationals can own property outright in designated zones-such villas in suburban master-planned communities are attractive to expatriate tenants seeking privacy and security.

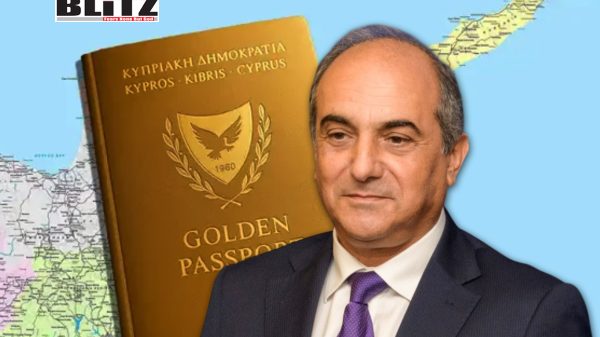

Li’s dual nationality adds complexity to the case. Saint Kitts and Nevis operates a long-standing citizenship-by-investment program that allows foreign nationals to acquire a second passport through qualifying financial contributions. Such citizenship can facilitate global mobility and access to banking systems, often making asset ownership across jurisdictions easier to structure.

Li was sentenced on February 9 by the US District Court for the Central District of California to 20 years in prison. The case was prosecuted by the United States Attorney’s Office, which described the scheme as a large-scale cryptocurrency investment conspiracy targeting American victims.

According to prosecutors, Li pleaded guilty in November 2024 to one count of conspiracy to commit money laundering. However, in December 2025, he allegedly cut off an electronic monitoring device from his ankle and fled before beginning his sentence, becoming a fugitive.

In a written response sent after his sentencing, Li described the US verdict as “unjust,” claiming he had been “deceived and induced” into pleading guilty. He stated that his legal team had filed an appeal. He did not respond to inquiries regarding his Dubai property holdings.

US authorities allege that Li and his co-conspirators operated a sophisticated online fraud network centered in Cambodia. In his plea agreement, Li admitted to participating in the creation of spoof domains and fraudulent websites designed to impersonate legitimate cryptocurrency trading platforms.

Victims were persuaded to deposit funds into what appeared to be high-yield crypto investment platforms. In reality, prosecutors say, the platforms were fraudulent and controlled by the conspirators. Funds deposited by victims were diverted and laundered through a network of shell corporations and bank accounts.

The US Attorney’s Office stated that Li admitted to laundering proceeds by channeling funds into US-registered shell companies, which then opened bank accounts to receive deposits. The money was subsequently transferred across jurisdictions and converted into digital assets.

Authorities said that part of the laundering process involved converting funds held in the Bahamas into USDT, or Tether. As a dollar-pegged stablecoin, USDT is frequently used in international crypto transactions due to its liquidity and price stability, making it a common tool in cross-border financial flows.

By converting fiat currency into cryptocurrency, the scheme allegedly exploited blockchain technology’s speed and relative anonymity to move funds across borders while obscuring the money trail.

Li was arrested in April 2024 at Hartsfield-Jackson Atlanta International Airport while entering the United States. The investigation was supported by the United States Secret Service, which has jurisdiction over financial crimes, including fraud and money laundering.

At the time of the arrest announcement, federal authorities described the scheme as transnational in scope, with operations stretching across Cambodia, the Bahamas, and the United States. Investigators alleged that the fraud systematically targeted US residents, extracting millions of dollars through false investment promises.

Li is one of eight individuals who have pleaded guilty in connection with the case. At least three other co-conspirators have already received prison sentences.

The discovery that Li owns property in Dubai raises broader questions about asset tracing and enforcement in cross-border financial crime cases. Dubai’s real estate market has historically attracted foreign investors due to favorable tax policies, relatively high rental yields, and legal frameworks permitting foreign ownership in designated areas.

While the United Arab Emirates has strengthened anti-money laundering regulations in recent years, real estate transactions globally remain under scrutiny by transparency advocates and international watchdog organizations as potential vehicles for storing or legitimizing illicit wealth.

In this case, publicly available tenancy records show the Dubai villa continues to generate income. It remains unclear whether US authorities will pursue asset seizure or forfeiture proceedings targeting overseas properties linked to Li.

Under US law, criminal forfeiture actions can extend to assets traceable to proceeds of crime. However, executing such actions internationally typically requires cooperation agreements and judicial processes within the foreign jurisdiction.

Li’s fugitive status complicates matters further. Courts often require a defendant to be physically present or in custody to fully pursue appellate remedies. At the same time, his absence may trigger additional charges related to escape or violation of supervised release conditions.

International law enforcement agencies may issue alerts or seek cooperation from partner countries to locate and apprehend him. However, cases involving dual nationality and multi-jurisdictional assets can present prolonged legal challenges.

For victims of the alleged $73 million scam, recovery of funds depends largely on the identification and freezing of traceable assets. The Dubai villa, if proven to be linked to illicit proceeds, could become part of broader recovery or forfeiture efforts.

The case highlights the evolving intersection between cryptocurrency markets, globalized fraud networks, and international real estate investment. It underscores how digital financial crimes frequently transcend borders, exploiting regulatory gaps and differences in legal frameworks.

The alleged use of shell companies, offshore bank accounts, and cryptocurrency conversions reflects patterns increasingly observed in transnational financial investigations. Meanwhile, real estate holdings-particularly in major global cities-remain a favored asset class for individuals seeking to diversify or preserve capital.

As authorities continue efforts to locate Daren Li and enforce the 20-year sentence handed down by the US court, his Dubai property stands as a tangible example of how alleged criminal proceeds can be embedded within legitimate-looking investments.

The unfolding legal process will likely test international cooperation mechanisms and asset recovery strategies in the era of digital finance. Until Li is apprehended or his appeal is adjudicated, both his personal legal outcome and the future of his overseas holdings remain unresolved.