Trump’s tariff gambit sends shockwaves through global markets

- Update Time : Tuesday, April 8, 2025

European stock markets were engulfed in turmoil on April 7, as investors reacted sharply to a sweeping set of new tariffs imposed by US President Donald Trump. The pan-European Stoxx 600 index plunged more than 6% shortly after markets opened, reaching its lowest level in 16 months and sparking fears of a prolonged global economic downturn. This came just days after Trump unveiled a new tariff regime targeting imports from dozens of countries, igniting a fresh wave of trade tensions not seen since the 2018-2019 US-China trade war.

The broad sell-off extended across the continent, with Germany’s DAX falling nearly 10%, France’s CAC 40 down 6.6%, and Italy’s FTSE MIB sliding 5.7%. The UK’s FTSE 100 also suffered its worst single-day decline since the early days of the COVID-19 pandemic, dropping 6%. Alarmingly, every stock in the FTSE 100 index was in negative territory within an hour of the London market opening-a rare and sobering signal of investor unease.

Sectors most sensitive to trade disruptions were hit particularly hard. Defense firms, banks, and industrial manufacturers bore the brunt of the selling pressure. Shares in German arms manufacturer Rheinmetall crashed nearly 24%, while UK-based Rolls-Royce shed 12%. Mining companies, closely tied to global trade flows and commodity demand, were also deeply affected. Financial institutions saw their valuations slashed as fears of slower global growth and tighter credit conditions mounted.

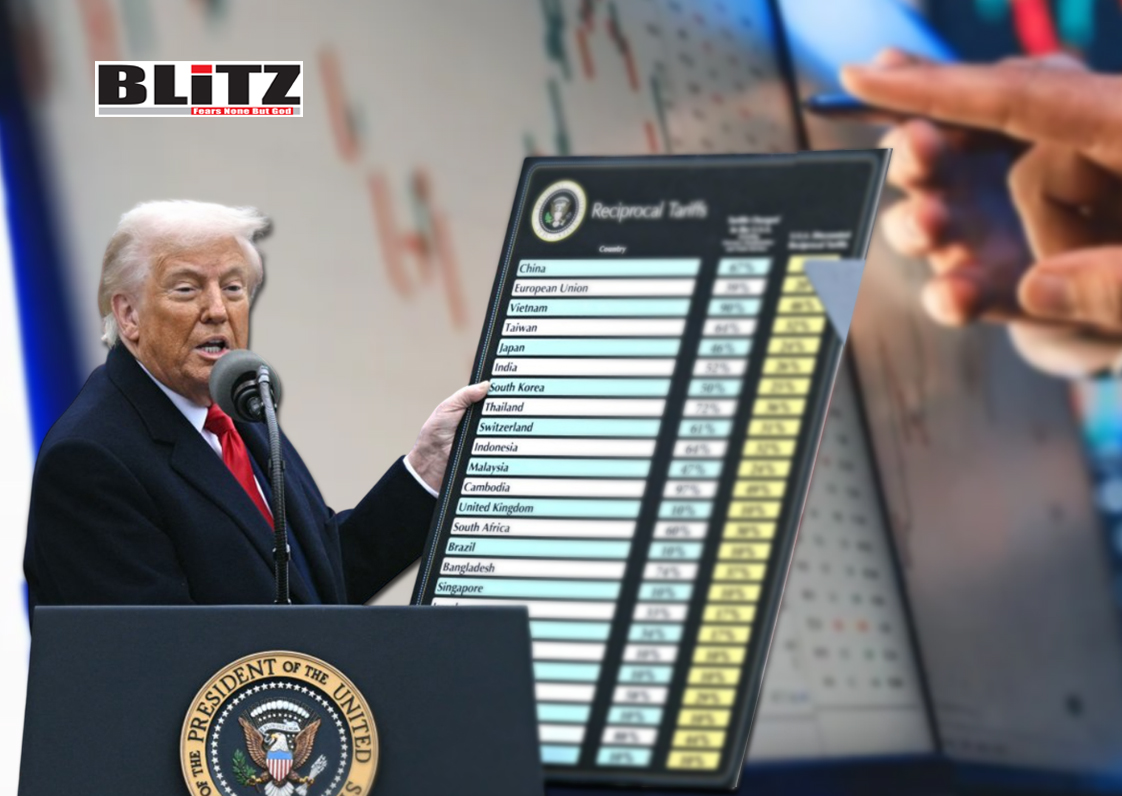

The scale of the decline underscores the market’s anxiety over the economic fallout from Trump’s latest protectionist measures. On April 2, Trump announced a 10% baseline tariff on all imports to the US, along with additional “reciprocal” tariffs that would target countries deemed to have unfair trade practices. Among the targets were key US allies, including the European Union, Japan, and South Korea. Under the new framework, EU goods now face a 20% tariff, a sharp escalation from previous trade terms.

The market rout in Europe followed similar scenes in Asia earlier that morning. Japan’s Nikkei 225 index fell to its lowest level since October 2023. Chinese stocks dropped significantly, as did those in South Korea, Taiwan, and Australia. US futures also pointed to another steep sell-off following last week’s brutal performance, where the S&P 500, Dow Jones Industrial Average, and Nasdaq all registered their worst weekly results since the March 2020 pandemic-induced crash.

Economists and market analysts have begun warning of a broader slowdown if the tariffs are not reversed. UBS Global Wealth Management chief economist Paul Donovan noted that mixed messages from the US administration have only deepened the uncertainty. “Over the weekend, US administration officials gave contradictory statements on trade taxes, causing investors to question the existence of a master plan,” Donovan said. “If the competence of policymaking is questioned, markets will worry that economic damage will be lasting.”

The European Union, which had until recently maintained cautious optimism about restoring transatlantic trade harmony, reacted swiftly. European Commission President Ursula von der Leyen announced that the EU would initiate urgent discussions with Washington later this week to avert a full-blown trade war. However, she made it clear that Brussels would not hesitate to act if the talks failed.

“We will pursue dialogue, but Europe will not be bullied,” von der Leyen said. “If the United States insists on imposing these unjustified tariffs, the European Union will respond in a unified and proportionate manner.”

Several member states, including France and Germany, have already drafted potential retaliatory measures, which may include tariffs on US agricultural products, consumer goods, and technology imports. Analysts warn that if both sides escalate their trade penalties, it could lead to a repeat of the damaging standoff that defined US-EU relations during Trump’s first term in office.

Despite mounting criticism, Trump has remained defiant. In a press conference on April 6, he insisted that the tariffs were essential to correcting what he called “decades of disastrous trade deals” that had hollowed out American manufacturing. “The era of America getting ripped off is over,” he declared. “These tariffs are about fairness, and every country that wants access to our market must play by our rules.”

Trump’s rhetoric may play well with segments of the US electorate concerned about industrial job losses, but it has sparked alarm among global investors. The sweeping nature of the tariffs, their sudden implementation, and the lack of diplomatic coordination have all contributed to an environment of deep market instability.

Market participants are now eagerly awaiting further guidance from Washington, particularly whether the White House is open to moderating or reversing the tariffs. Kathleen Brooks, research director at trading platform XTB, emphasized that sentiment hinges on immediate action. “This market is looking for concrete action, not talk of action,” she wrote in a note. “The best panacea for financial markets right now would be a pause or reversal from the US on its tariff program.”

Until such a signal is given, traders are bracing for more volatility. The bond markets have already started pricing in a potential slowdown, with yields falling across the US and Europe as investors seek the safety of government debt. Meanwhile, the dollar remains strong, which could further hurt emerging markets already dealing with capital outflows and inflationary pressures.

This latest trade skirmish comes at a time when the global economy is still recovering from the combined shocks of inflation, high interest rates, and the lingering effects of the COVID-19 pandemic. With geopolitical tensions flaring in Eastern Europe, the Middle East, and the Asia-Pacific, any further disruptions to trade could exacerbate existing vulnerabilities.

While Trump’s base may see the tariffs as a bold reassertion of American economic power, the reaction from markets suggests that investors view them as a reckless gamble. With the US heading into an election season, and global institutions like the World Trade Organization already weakened, the risk of long-term structural damage to international trade cannot be dismissed.

In the short term, all eyes will be on the upcoming EU-US negotiations. If a diplomatic off-ramp can be found, markets may stabilize. But if not, the world may be on the brink of another global trade war-one that could rival or exceed the economic damage of the last.

Leave a Reply