China accuses US of economic bullying amid escalating trade war

- Update Time : Tuesday, April 8, 2025

Tensions between the United States and China have once again flared as Washington’s imposition of steep new tariffs triggered a swift retaliatory response from Beijing. China’s Foreign Ministry has denounced the US move as “economic bullying,” warning of grave consequences for the global economy, financial markets, and the already fragile framework of international trade rules.

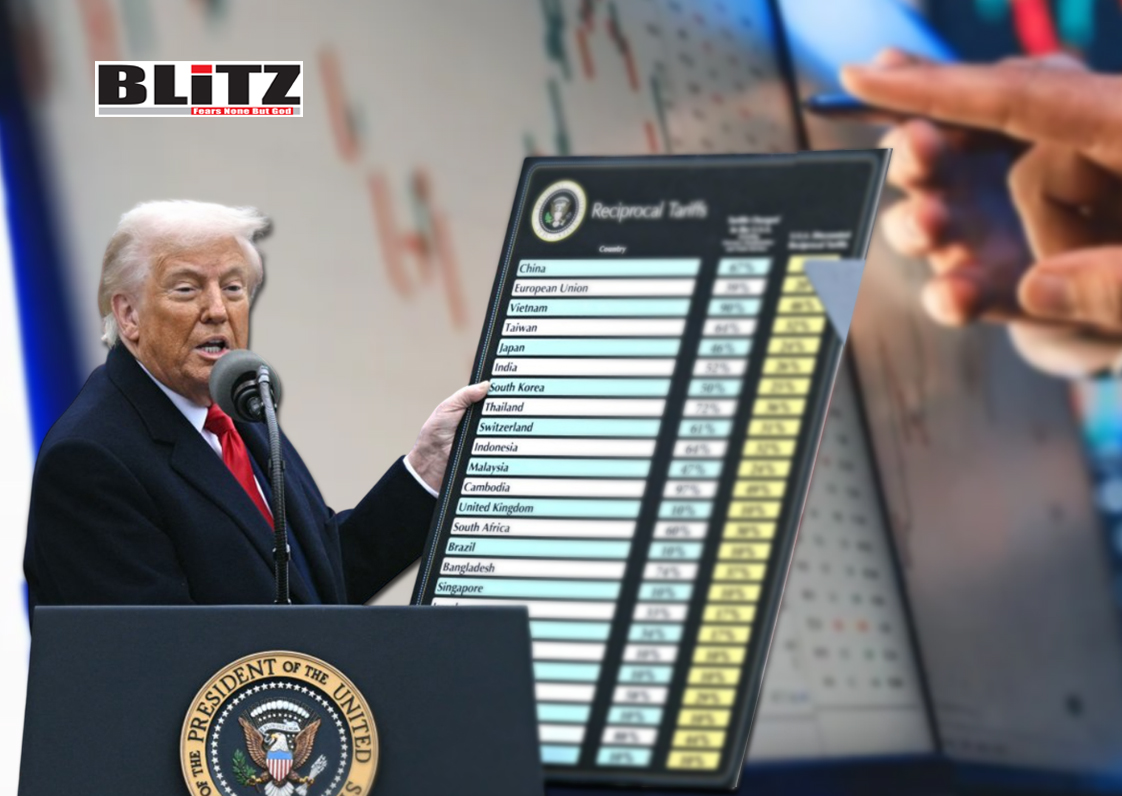

At the center of the latest escalation is a new 34% tariff imposed by the US on Chinese exports, adding to the existing 20% duties. With total levies now reaching at least 54%, the decision has sent shockwaves through the international financial system and drawn sharp condemnation from Beijing. Chinese Foreign Ministry spokesperson Lin Jian, speaking at a regular press conference on April 7, characterized the measure as a blatant act of “unilateralism, trade protectionism, and economic bullying.”

“These tariffs seriously impact the stability of the global economic order,” Lin said, underscoring what many in Beijing see as an aggressive and irresponsible turn in US trade policy.

In swift retaliation, China’s Finance Ministry announced on April 4 that it would slap an identical 34% tariff on all US imports starting April 10. In parallel, China has filed a formal complaint with the World Trade Organization (WTO), challenging what it sees as a violation of multilateral trade norms.

The new tariffs represent a significant re-escalation in trade hostilities between the two economic giants, echoing the trade war that gripped global markets during the Trump administration’s first term. Though initially eased during the Biden years, underlying tensions never fully dissipated, and the latest move signals a sharp return to tariff-driven economic confrontation.

China’s response, far from being symbolic, is intended to project strength and deterrence. According to the state-affiliated Global Times, Beijing’s countermeasures are not merely economic but also political, designed to showcase China’s “firm resolve” against the “reckless violation” of international norms by the United States.

“Instead of taking responsibility for its declining competitiveness in manufacturing,” the Global Times wrote in an editorial published April 7, “the US chooses to shift blame abroad and escalate economic conflict.”

This narrative, heavily emphasized in Chinese state media, paints the US not as a victim of unfair trade but as a declining power looking to shield its industries from global competition through coercive tactics.

Financial markets across the globe have already begun to react to the renewed hostilities. European, Asian, and US stock indices all fell in response to the news, with technology and manufacturing sectors taking some of the heaviest hits.

Economists have warned that the tit-for-tat measures may have cascading effects on global supply chains, consumer prices, and overall economic growth. Goldman Sachs, citing the increased risks posed by deteriorating US-China relations, has raised the probability of a US recession within the next 12 months to 45%.

The Bank of Japan and the European Central Bank both issued cautious statements, suggesting that protracted trade tensions could erode business confidence and investor sentiment, slowing down economic recoveries in regions already grappling with inflation and structural weaknesses.

The WTO, which has faced increasing criticism over its inability to enforce trade norms in recent years, is once again in the spotlight. While China’s legal challenge may help bolster its international image as a defender of multilateralism, few observers expect the organization to effectively mediate the conflict, given the United States’ historical skepticism toward its rulings.

On the American side, the decision to impose new tariffs may be driven as much by political calculation as by economic reasoning. With a presidential election looming in November, and the manufacturing heartlands of the US still struggling to regain their competitive edge, the tariff hike may serve to shore up political support among key voter blocs in the industrial Midwest.

President Donald Trump, the presumed Republican nominee, has long advocated for punitive tariffs on Chinese goods, arguing that they are essential to protect American jobs and industry. The current administration, wary of appearing weak on trade, may be adopting a similar stance to prevent losing ground to nationalist rhetoric.

But critics argue that the approach is shortsighted. Rather than investing in structural reforms, skills development, and innovation, Washington appears to be defaulting to protectionist measures that could boomerang economically.

“Tariffs are not a long-term solution,” said Jennifer Lee, senior economist at BMO Capital Markets. “They are a band-aid at best-and one that can peel off painfully, especially when met with retaliation.”

What makes the current flare-up particularly dangerous is the global context. With wars ongoing in Ukraine and the Middle East, energy markets under strain, and global debt levels reaching new highs, the world economy is in a precarious position. The IMF and World Bank have repeatedly warned that any major disruption to global trade could tip the balance into recession, particularly in developing economies already burdened by inflation and capital flight.

The stakes, therefore, go well beyond the US and China. Countries heavily dependent on exports, like Germany, South Korea, and Mexico, may suffer from spillover effects. Even countries not directly involved in the dispute could see rising costs for key goods and intermediate inputs as global supply chains are disrupted.

There is also the question of long-term decoupling. If both Washington and Beijing continue on this path, the fragmentation of global trade could accelerate, leading to competing economic blocs and a decline in multilateralism.

In accusing the United States of “economic bullying,” China has signaled its unwillingness to be coerced into economic submission. In imposing fresh tariffs, the US has demonstrated that it is prepared to escalate the trade war in pursuit of domestic political and economic goals. Neither side is showing signs of backing down.

As the world watches with unease, what’s unfolding is more than just a bilateral trade dispute. It is a contest over who sets the rules of the global economic order-a clash of ideologies between state-driven capitalism and liberal market democracy.

Unless cooler heads prevail and diplomacy returns to the forefront, the world could be heading into another prolonged period of economic instability, with repercussions that may far outlast this round of tariffs.

Leave a Reply