While jointly receiving the Nobel Peace Prize along with Grameen Bank from Professor Ole Danbolt Mjøs, Chairman of the Norwegian Nobel Committee on December 10, 2006 for “their efforts to create economic and social development from below”, in presence of global dignitaries, Muhammad Yunus declared – “We can put poverty in the museum”. Commenting on Yunus, UK daily The Guardian in an article said: For Nelson Mandela it was apartheid, for Mahatma Gandhi it was self-rule, for Prof Yunus it is poverty.

“He told me that he had a dream of setting up a museum of poverty; a building where the children of the future would go and marvel at the phenomenon of poverty. They would ask questions which couldn’t be answered: “There was great wealth and prosperity and everyone was splurging, so why were others poor and dying?”

At that time a sizable number of people – including journalists were feeling encouraged knowing Nobel laureate Muhammad Yunus would put poverty in the museum. After 17 years of receiving the prestigious prize – Muhammad Yunus has not succeeded in sending poverty to museums. Instead, millions of borrowers of loan from him in Bangladesh now are facing cruel sufferings due to poverty while most possibly, Yunus has engaged ‘reputation management’ firms to remove everyone on the web about his pronouncement of sending poverty to museums. Why?

Danish investigative journalist Tom Heinemann, revealed a number of secret documents proving how Muhammad Yunus back in the mid-90’s transferred 100 million dollars – where most was donated as grants from Norway, Sweden, Germany, the United States and Canada – to a new company in the Grameen-family – mostly owned by his family members – in order to dodge taxes.

Tom Heinemann also exposed how Muhammad Yunus was charging high-interest rates ranging between 21 to 37 percent from the vulnerable poor female borrowers, although Yunus was receiving the majority of the fund as grant from various countries in the world.

Taking a lead from a series of investigative reports published in Weekly Blitz, Tom Heinemann also tried to dig further into the case of Sufia Begum, the poster-woman of Yunus and Grameen Bank.

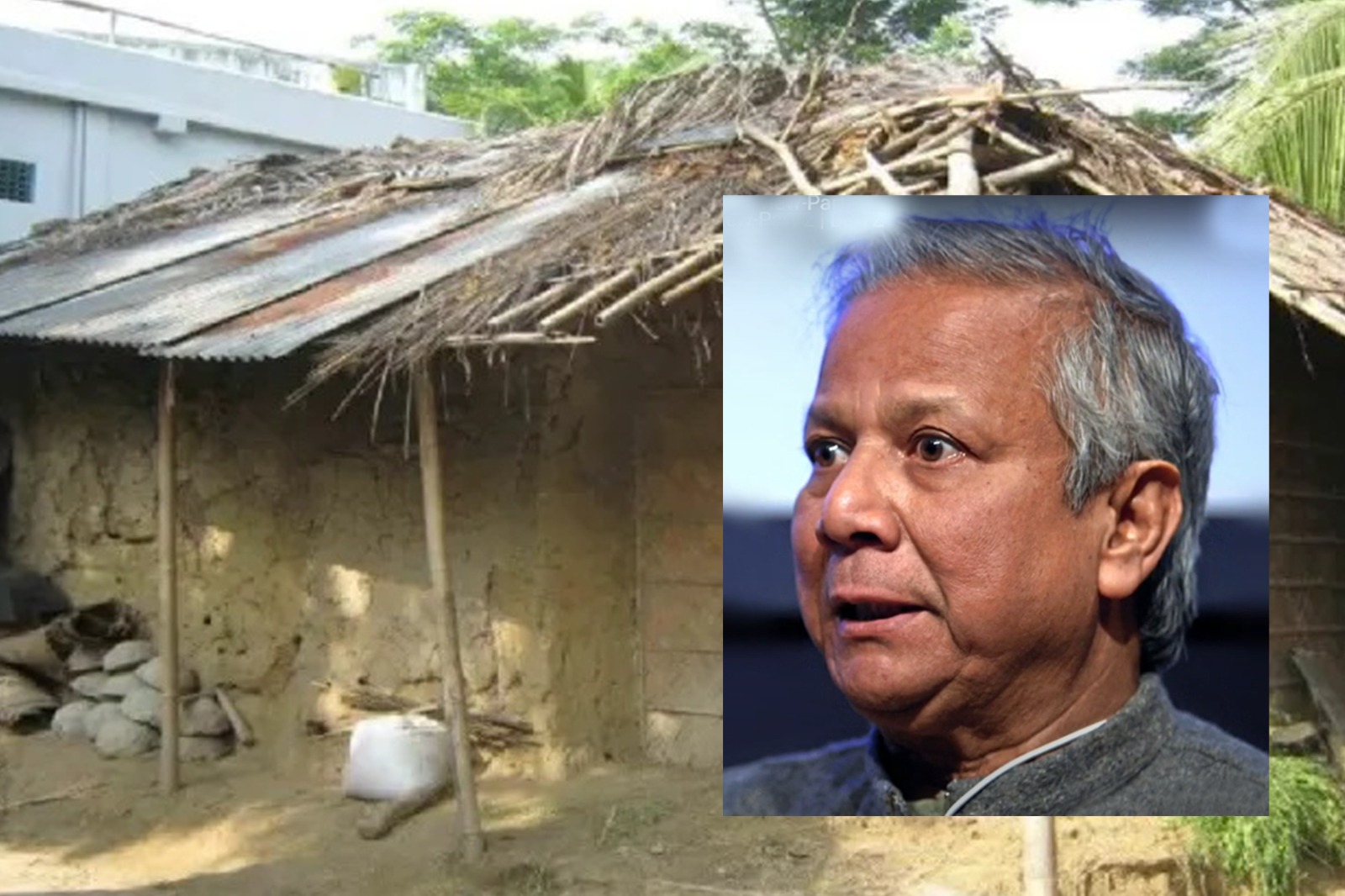

The story of Sufia Begum reads like this: Yunus gave BDT 20 [US$ 0.25] to Sufia Begum of Jobra village years back as loan with the condition of returning in time with interest. Sufia returned that money and got a second loan of BDT 500 from Yunus. She was so excited that she spread the news in the entire village. This was the beginning of the Grameen Bank concept. But, most of the borrowers, who took money from Yunus, gradually turned from poor to poorest as they were compelled to pay regular interest at high rates. In Jobra village alone, a large number of villagers have already been turned into paupers by Yunus and his Grameen Bank.

Yunus and his Grameen Bank projected Jobra village and Sufia as examples of their “excellent success stories” to the international audience. Through such a campaign, Yunus has attained tremendous attention from the international community, including journalists.

Uday Kumar Barua, a resident of Jobra village told reporters that, even a single person in the Jobra village has not benefited by Muhammad Yunus. Most of the borrowers turned completely pauper and they even had to sell their homes to pay the loan interest and left the village. Many of them even ended up as beggars. Even after being sacked from his position in the Grameen Bank, Yunus continues to keep virtual ownership of Grameen Bank and the entire fifty-five sister enterprises established under this umbrella, such as Grameen Phone and Grameen Kalyan.

Muhammad Yunus gained fame in the world as a ‘pioneer’ of micro credit, for which Bill Clinton had personally pursued and succeeded in letting Yunus receive the prestigious Nobel Peace Prize in 2006.

By that time, the name of Sufia Begum, the first borrower of Yunus’s Grameen Bank, had already crossed into many countries in the world, as Grameen Bank proudly pronounced her name as one of the brilliant success stories of their so-called micro-credit loans. It is beyond knowledge of many that, almost one decade back, Sufia died due to extreme poverty and lack of any minimum medical treatment.

On December 6, 2010, Parminder Bahra in an article in The Wall Street Journal described irregularities of Muhammad Yunus in handling foreign funds.

Weekly Blitz also reported that Yunus took former US first lady Hillary Clinton at Grameen Bank’s project situated at Rishi Palli at Moshihati in Bangladesh, where Yunus initiated a project named ‘Hillary Adarsha Palli’ (Hillary Model Village) and promised locals of providing loans, homes and better lives.

While Hillary Clinton was deeply impressed at this venture and as Yunus gave her assurance of providing soft-term loans to the poor villagers, in reality, the villagers were made to pay 30-40 percent interest – while the majority of them received nothing. In fact, to impress Hillary Clinton, Yunus brought truck-loaded people from other areas and presented them as residents of proposed ‘Hillary Model Village’, while the crowd were sent back immediately after Hillary Clinton’s departure.

After the visit of Hillary Clinton, the entire village turned into a land of horror. Extreme poverty due to high interest charged by the Grameen Bank pushed them towards starvation, poverty and compelling many of them to commit suicide. Child marriage is very common in that village. A large number of females from the village ended up in local and neighboring brothels, as they were virtually sold by parents due to poverty. Now, ‘Hillary Model Village’ has turned into a big joke to the locals. But Yunus was successful in tactfully suppressing this fact from the attention of Hillary Clinton. Tom Heinemann has also covered this issue in his documentary named ‘The Micro Debt’.

On January 1, 2024, a labor court in Dhaka, Bangladesh sentenced Grameen Telecom chairman and controversial Nobel Laureate Dr Muhammad Yunus and three others to six-months jail in a case filed against them for violating labor law.

According to the case documents, a team of the Department of Inspection for Factories and Establishments DIFE went on an inspection to the Grameen Telecom and found the violations of labor laws like not regularizing 101 staff, not establishing a welfare fund for the laborers, and not paying five percent of the company’s dividends to the workers, among others.

Following the verdict, Muhammad Yunus claimed they were being punished for a “crime they had not committed”.

“If you want to call it justice, you are free to do so”, the controversial Nobel laureate told reporters on the court premises in response to a question.

“It was in our fate, in the nation’s fate”, he added.

It is well-anticipated that, due to his global image of being the “Mother Teressa” of the poor, Muhammad Yunus shall succeed in manipulating the international media and use it against his imprisonment verdict thus branding it as a repressive act of the Bangladesh government. Influential friends of Yunus, including Hillary Clinton may also extend their hands of cooperation to him. In this case – for journalists around the world, for upholding the ethics of our profession, it would be wise to investigate the entire case of Muhammad Yunus and January 1, 2024 jail sentences, so that our pens are not used to defend the wrong person. At the same time, we may ask the Nobel laureate – what has happened to his 2006 pledge of sending poverty to museums.

Now this information shall continue getting spread throughout the world. Thanks to team Blitz for revealing the truth centering Prof Yunus.

Why Bangladesh’s media outlets are maintaining silence on this issue?

Unfortunately most of the media outlets in Bangladesh are totally silent on this issue. Why? They don’t dare confronting Yunus.

Excellent report. It exposes Yunus with evidence and references. I am a bit surprised, why most of the newspapers in Bangladesh are silent on this matter.

Yunus is a grand scammer.